About Us

Skip to content

Open Enrollment - May 2024

The month of May is Pekin 108's open enrollment month. Employees are able to make changes to insurance coverage, enroll in our flexible spending plan or other benefits, or terminate coverage during this time. At other times throughout the year, employees may make changes with a qualifying life event. All applicable forms and the related information is available through this page. Please contact Caty Campbell in the Business Office at caty.campbell@pekin108.org if you have any questions.

You can return your forms to the Business Office by mail (501 Washington St, Pekin IL 61554), drop-off or by email.

All changes made during the open enrollment period became effective on July 1, 2024 and will remain in effect until June 30, 2025 unless you notify the Business Office of a qualifying event. Qualifying event changes will be determined on a case-by-case basis, but you must notify the Business Office within 31 days of the life event.

Overview of Employee Benefits

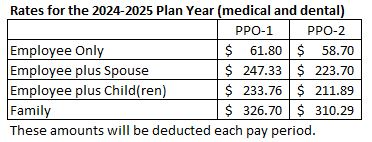

Health and Dental Insurance

If you want to enroll or add dependents to your BCBS (medical and dental) or VSP vision insurance, please complete the appropriate enrollment form and return to the Business Office.

If you want to terminate coverage or remove dependents from your BCBS or vision insurance, please send me an email notifying me of the requested change.

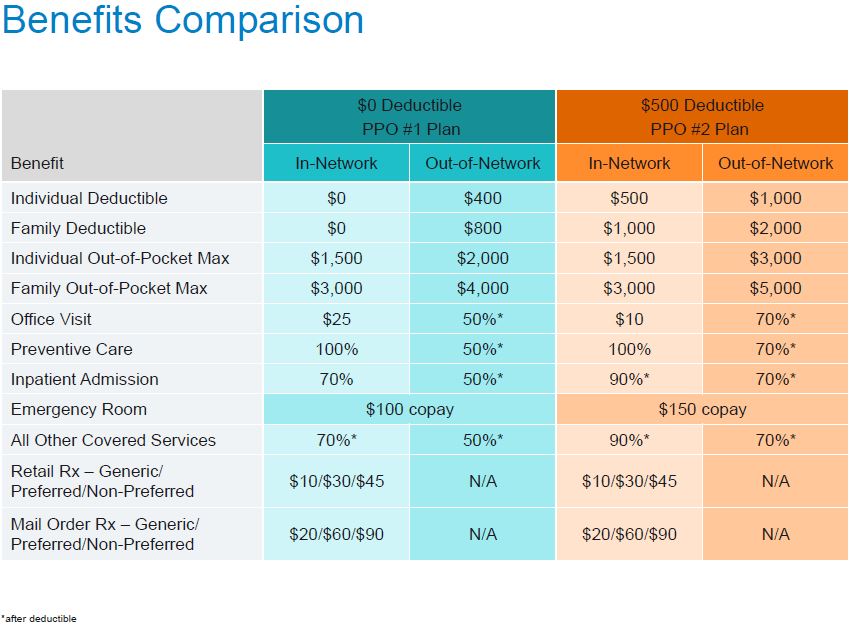

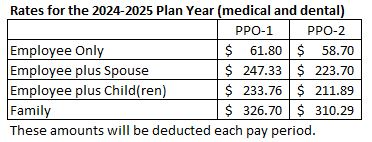

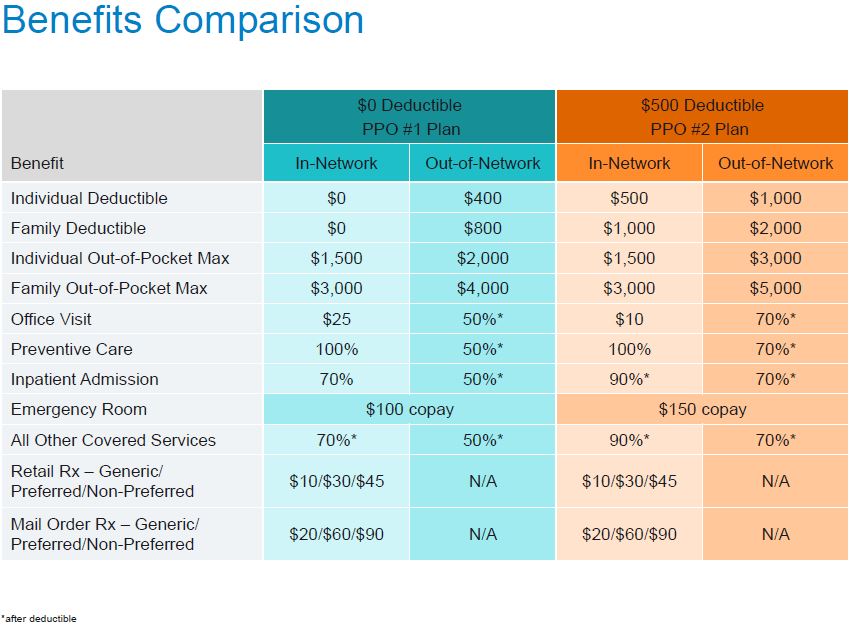

BCBS Plan Information (view more plan information here)

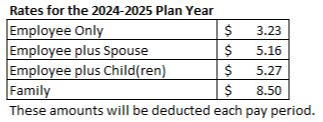

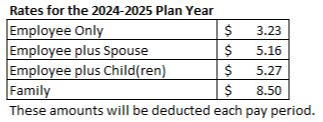

Vision Insurance

Flex Spending for Medical Expenses or Dependent Care - NEW PLAN ADMINISTRATOR

Effective July 1, 2024, Pekin 108 will use TASC as our flexible spending plan administrator.

If you want to enroll in the flexible spending plan for medical reimbursement or dependent care, please complete the TASC enrollment form. If you do not return this form, you will not be enrolled in the flex spending plan for 2024-2025.

TASC Flex Spending for Medical Expenses or Dependent Care Expenses Enrollment Form

You will only enroll yourself, as the employee, but you can use your flexible spending election for any of your tax dependents.

Maximum Election for Medical Expenses - $3,200 ***carryover of $640 allowable at June 30, 2025***

Maximum Election for Dependent Care Expenses - $5,000

Plan Participation Fee - $45.00

Deductions will come out of 20 pays, August 25, 2024 - June 10, 2025.

Find out more information about our new FSA plan administrator at www.tasconline.com.

Current plan participants - those who participated in the 2023-2024 plan year - who have flex spending funds still available must submit claims to GPS for any dates of service prior to July 1, 2024 by September 30, 2024.

All new plan participants must submit claims to TASC for dates of service on or after July 1, 2024. Plan participants will receive information on how to set up an account and submit claims directly from TASC soon after enrollment period ends.

Other Voluntary Options

Colonial Life Voluntary Insurance

Colonial Life offers other types of voluntary coverage, such as accident, cancer and life insurance. See contact information on the flyer below.

IMRF Voluntary Additional Contribution Program

This program allows for IMRF contributors to put aside funds to be used for retirement or other purposes. Funds are deducted through payroll after taxes and then held by IMRF. Interest is credited to your account only once a year; however, funds put into this program are currently being paid interest at 7.25% (effective 1/1/2019). You can elect to contribute up to 10% of your earnings. This is not to be seen as a short-term savings account as you can withdraw your contributions, but you must apply for a refund of all of your contributions when you do. These funds can be applied to your monthly retirement annuity if your balance in the VAC program at the time of retirement is at least $4,500. You can enroll in the program or make changes to your contributions through your online IMRF account at www.imrf.org.

Additional information can be found on the IMRF website here: https://www.imrf.org/en/members/tier-2-regular-plan/voluntary-additional-contributions.

Illinois Consumer Coverage Disclosure Act SB1905

A new Illinois law requires that all employees who are gainfully employed in the State of Illinois and covered by employment-based group medical plans receive an Essential Health Benefit (EHB) comparison between the Illinois benchmark plan and what we offer to our employees under the company-sponsored medical plans. Attached is such a comparison that we are providing in order to comply with this law.

2024 BCBS - Illinois Essential Health Benefit (EHB) Listing (PA 102-0630)

If you have any questions regarding the above or attached, please contact Caty Campbell.